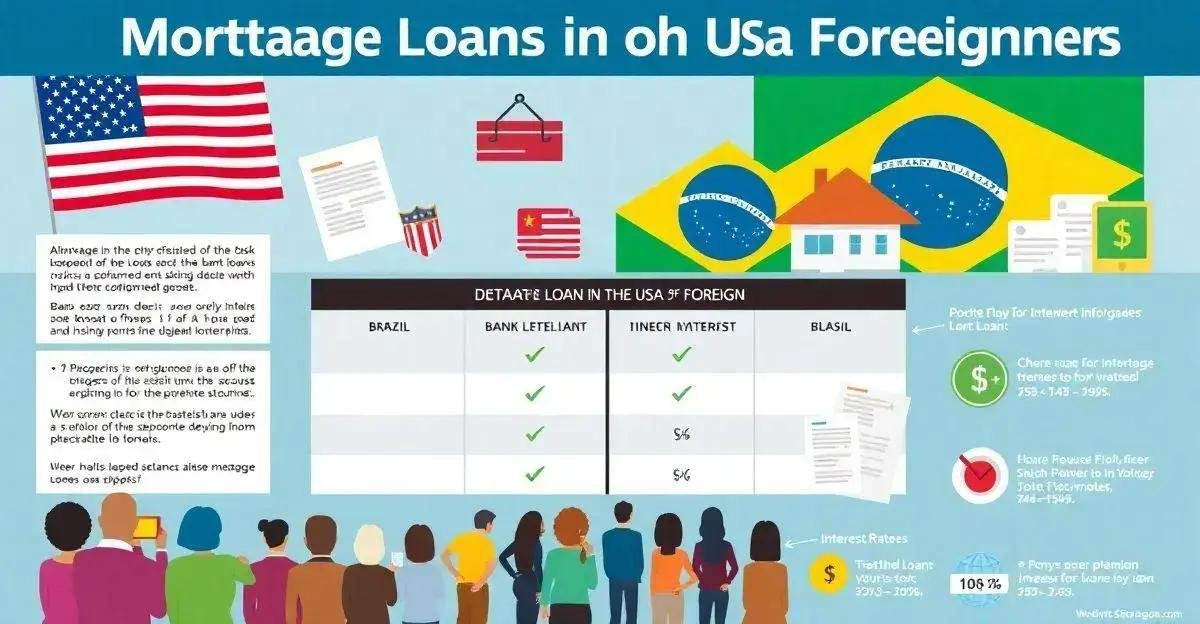

Are you a foreigner looking to purchase a property in the United States? Securing a mortgage loan can be a daunting task, but with the right guidance, you can achieve your dream.

In this comprehensive guide, we will explore the world of mortgage loans in the USA for foreigners, covering the options available, eligibility criteria, and the application process.

Veja também: Metaverse Tokens: Is It Worth Investing in 2024?

Mortgage Options for Foreigners in the USA

For foreigners looking to secure a mortgage loan in the USA, there are several options available. The most common are fixed-rate and adjustable-rate mortgages, with fixed-rate mortgages offering predictability and adjustable-rate mortgages providing flexibility. Additionally, foreign nationals can also consider government-backed mortgages, such as FHA and VA loans, which have more lenient credit requirements and lower down payments. It’s essential to understand the pros and cons of each option to make an informed decision.

Eligibility Criteria for Foreigners

Foreign nationals seeking to secure a mortgage loan in the USA must meet specific eligibility criteria. To qualify, you must have a valid passport, proof of income, and a credit score of at least 700. Additionally, foreign nationals must demonstrate a down payment of at least 20% and a debt-to-income ratio of less than 36%. Some mortgage lenders may require a higher credit score and a larger down payment. It’s crucial to understand these criteria to ensure you’re prepared for the mortgage application process.

Documents Required for Mortgage Application

To apply for a mortgage loan in the USA as a foreigner, you’ll need to provide a range of documents to support your application. These include your passport, proof of income, bank statements, and credit reports.

Additionally, you may also need to provide tax returns, employment contracts, and other financial documents. It’s essential to ensure you have all the necessary documents in order to avoid delays in the application process.

In this article, we’ll outline the documents required for mortgage application and provide tips on how to prepare your application.

Mortgage Loan Options and Interest Rates

Mortgage loan options and interest rates can vary significantly depending on the lender and your individual circumstances.

Fixed-rate mortgages typically offer lower interest rates than adjustable-rate mortgages, while government-backed mortgages often have more competitive rates.

Foreign nationals may also find that interest rates are higher due to higher credit risk.

In this article, we’ll explore the different mortgage loan options available to foreigners in the USA and provide tips on how to secure the best interest rate for your mortgage loan.

Tips for Foreigners to Secure a Mortgage in the USA

Securing a mortgage loan in the USA as a foreigner can be challenging, but with the right strategies, you can increase your chances of approval.

In this article, we’ll provide tips on how to improve your credit score, gather required documents, and work with the right lenders to secure a mortgage loan.

Key Factors to Consider

Additionally, we’ll discuss the importance of having a stable income, a solid credit history, and a down payment in order to secure a mortgage loan.

By following these tips, you can successfully navigate the mortgage loan application process and achieve your goal of owning a property in the USA.

Mortgage Loan Application Process for Foreigners

The mortgage loan application process for foreigners in the USA can be complex and time-consuming. It’s essential to have all the necessary documents and information ready to ensure a smooth application process.

In this article, we’ll break down the mortgage loan application process step by step, from pre-qualification to loan approval.

We’ll also provide tips on how to work with lenders, handle credit inquiries, and avoid common mistakes that can delay or deny your loan application.

FAQ – Frequently Asked Questions about Mortgage Options for Foreigners in the USA

What are the mortgage options available to foreigners in the USA?

There are various mortgage options available to foreigners in the USA, including fixed-rate and adjustable-rate mortgages, government-backed mortgages, and jumbo loans.

What are the eligibility criteria for foreigners to obtain a mortgage in the USA?

Foreign nationals must meet specific eligibility criteria, including having a valid passport, proof of income, and a credit score of at least 700.

What documents are required for a mortgage application in the USA?

Foreigners need to provide a range of documents, including their passport, proof of income, bank statements, and credit reports.

How can foreigners secure a mortgage loan in the USA?

Foreigners can increase their chances of securing a mortgage loan by having a solid credit history, stable income, and a down payment.

What is the mortgage loan application process like for foreigners in the USA?

The mortgage loan application process for foreigners in the USA involves several steps, including pre-qualification, submitting a formal mortgage application, and loan approval.

Are there any tips for foreigners to secure a mortgage loan in the USA?

Yes, there are several tips that foreigners can follow to increase their chances of securing a mortgage loan, including working with reputable lenders, having a solid credit history, and making a larger down payment.